The book is written by Dursun Delen, who serves as Professor of Management Science and Information Systems in the Spears School of Business at Oklahoma State University (OSU). I decided to go through this book to see if it would present additional and useful ways to address the Prescriptive Analytics broader vision under a business perspective, which is what I teach for the Master’s in Business and Master’s in Management classes that I usually lecture.

The author claims that the book is written for professionals who are interested in developing a holistic understanding about business analytics-especially about prescriptive analytics and for college students at graduate and undergraduate levels who need a book nicely balanced between theory and practice in explaining prescriptive analytics as the top layer in the business analytics continuum. He explains that the book aims to provide an end-to-end, all-inclusive, holistic approach to prescriptive analytics not only covering optimization and simulation, but also including multi-criteria decision-making methods along with inference- and heuristic-based decisioning techniques.

The book is enhanced with numerous conceptual illustrations, example problems and solutions, and motivational case and success stories.

The twenty-three main takeaways that I got out of this book are presented below:

- Largely driven by the need to make better and faster decisions, business analytics has been gaining popularity faster than any management trends we have seen in recent history. Some of the most reputed consultancy companies are projecting business analytics to grow three times the rate of other business segments in upcoming years, and named analytics as one of the top business trends of this decade. Since Thomas H. Davenport and Jeanne G. Harris’s 200-book, Competing on Analytics: The New Science of Winning, many books and research studies have asserted that embracing business analytics strategically leads to making better and faster decisions toward improving customer satisfaction, competitive posture, and shareholder value. Because of these testaments, in recent years we have seen tremendous growth in adoption of analytics-enhanced managerial practices from all types of businesses and organizations.

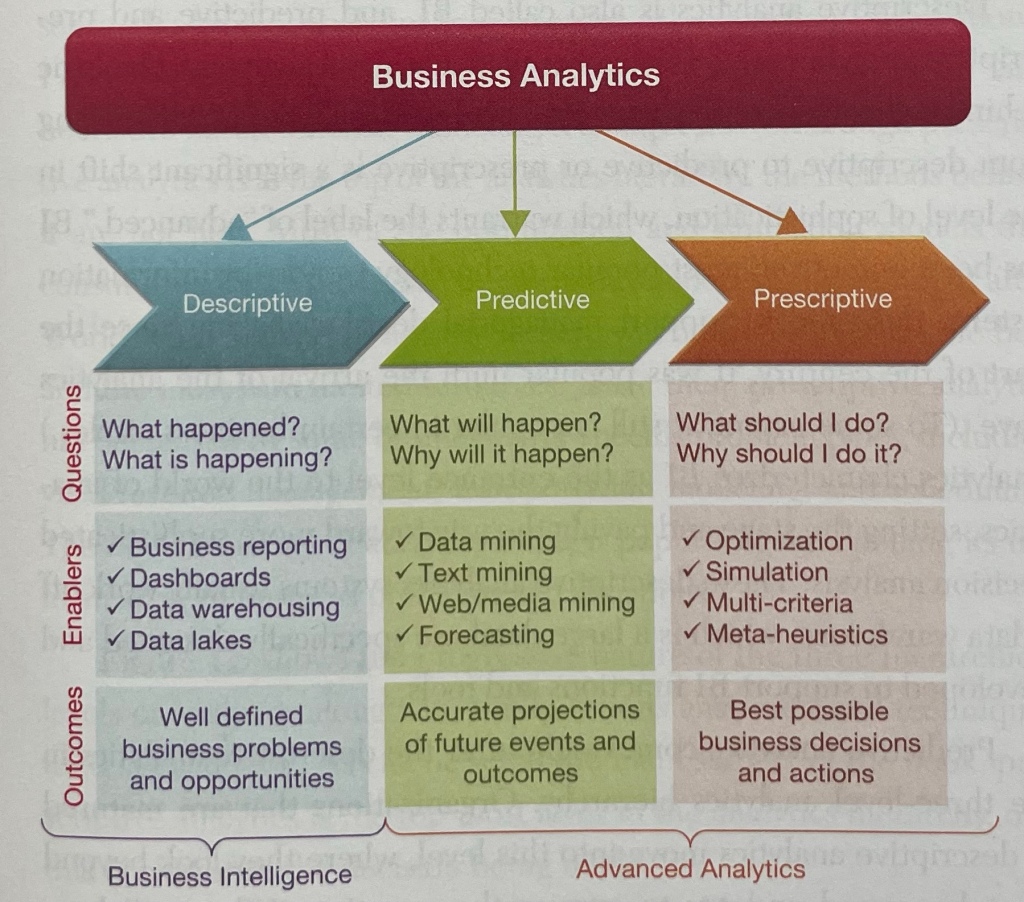

- Within the analytics ecosystem, almost all providers have their own definition of business analytics each purposefully focusing on some combination of hardware and/or software capabilities-collectively resulting in more confusion than clarification. As an attempt to unify the understanding of “what business analytics is” the business community along with the educational community have developed a simple taxonomy where they defined analytics using three progressive phases/echelons: descriptive/diagnostic analytics -> predictive analytics -> prescriptive analytics.

- Prescriptive Analytics is the highest echelon in the analytics continuum, which is the one closest to “making accurate and timely decisions” While the first two echelons (descriptive/diagnostic analytics and predictive analytics) focus on discovering and creating insight from date, prescriptive analytics focuses on making the best decisions.

- Prescriptive analytics and optimization are often used synonymously. Generally speaking, to optimize means “to improve” or “to make some outcome better.” In business analytics, however, to optimize means a proven mathematical modeling process to find the best possible solution optimal use of the limited resources toward achieving the business objectives while complying with a number of constraints. Although, at least conceptually, optimization suitably describes the purpose behind prescriptive analytics, the practicality and generalizability of the same extends beyond optimization to include simulation, multi-criteria decision modeling, heuristics and inferential knowledge representation, as well as the new and highly promising enablers such as Big Data, deep learning, and cognitive computing. These latest trends allow for richer and better insight creation toward immediate and accurate courses of action.

- Business Analytics and Decision-Making – Business analytics is a relatively new term that has been gaining popularity in the business world like nothing else in recent history… In most general terms, business analytics is the art and science of identifying or discovering novel insight from large volumes and varieties of data by means of using sophisticated machine learning, mathematical, and statistical models to support more accurate and timely managerial decision-making. So, in a sense, business analytics is all about decision-making and problem-solving… Nowadays, business analytics can simply be stated as “the process of discovering meaningful and actionable insight in data.”

- Data and Business Analytics – Because we are living in an era of data, the business analytics definitions are mostly focused on the digitization of data that is constantly flowing in, both from within and from outside the organization, in large quantities and many varieties… Although the most current definitions of analytics are primarily data focused, there are and there have been many applications of analytics involving little or no data; instead, those analytics projects used mathematical models that relied on process description and expert knowledge (for example, optimization and simulation models, expert systems, and multi-criteria decision-modeling methods).

- Business analytics is the application of analytics models and methodologies, tools, and techniques to solve ever-so-complex business problems. Organizations commonly apply analytics to large collections of data to describe (better understand the internal factors), predict (foresee the future trends), and prescribe (find the best possible course of action) for improving business performance.

- Analytics, perhaps because of its rapidly increasing popularity as a buzzword, is being used to replace several previously popularized terms such as intelligence, mining, and discovery. For example, the term business intelligence is now business analytics; customer intelligence is now customer analytics; Web mining is now Web analytics; and knowledge discovery is now data analytics… Because modern-day analytics can require extensive computation (due to the volume, variety, and velocity of data- the Big Data), the tolls, techniques, and algorithms used for analytics projects leverage the most current, state-of-the-art methods developed in fields that include management science, computer science, statistics, data science, computational linguistics, and mathematics.

- Are decision makers really rational? Some researchers question the concept of rationality in decision-making. There are countless cases of individuals and groups behaving irrationally in real-world and experimental decision-making situa-tions. For example, suppose you need to take a bus to work every morning, and the bus leaves at 7:00 a.m. If it takes you one hour to wake up, prepare for work, and get to the bus stop, you should always awaken at or before 6:00 a.m. However, sometimes you may sleep until 6:30, knowing that you will miss breakfast and not perform well at work. Or you may be late and arrive at the bus stop at 7:05, hoping that the bus will be late, too. So, why are you late? Multiple objectives and hoped-for goal levels may lead to this situation. Or your true expected utility for being on time might simply indicate that you should go back to bed most mornings!

- Good enough or satisficing? According to Simon (1977), most human decision-making, whether organizational or individual, involves a willingness to settle for a satisfactory solution, “something less than the best.” When satisficing, the decision-maker sets up an aspiration, a goal, or a desired level of performance and then searches the alternatives until one is found that achieves this level. The usual reasons for satisficing are time pressures (e.g. decisions may lose value over time), the inability to achieve optimization (e.g., solving some models could take longer than until when the sun is supposed to become a supernova), and recognition that the marginal benefit of a better solution is not worth the marginal cost to obtain it. In such a situation, the decision-maker is behaving ratio-nally, though he or she is actually satisficing. Essentially, satisficing is a form of suboptimization. There may be a best solution, an opti-mum, but it would be difficult to attain it. With a normative model, too much computation may be involved, with a descriptive model, it may not be possible to evaluate all the sets of alternatives.

- Developing (Generating) Alternatives – a significant part of the model-building process is generating alternatives. In optimization models (such as linear programming), the alternatives may be generated automatically by the model. In most decision situations, however, it is necessary to generate alternatives manually. This can be a lengthy process that involves searching and creativity, perhaps utilizing electronic brainstorming in a group support system (GSS). It takes time and costs money. Issues such as when to stop generating alternatives can be important. Too many alternatives can be detrimental to the process of decision-making. A decision-maker may suffer from information over-load. Generating alternatives is heavily dependent on the availability and cost of information and requires expertise in the problem area. This is the least formal aspect of problem-solving. Alternatives can be generated and evaluated using heuristics. The generation of alternatives from either individuals or groups can be supported by electronic brainstorming software in a Web-based GSS. Note that the search for alternatives usually occurs after the selection of the criteria for evaluating the alternatives are determined. This sequence can ease the search for alterna tives and reduce the effort involved in evaluating them, but identilying potential alternatives can sometimes aid in identifying criteria. The outcome of every proposed alternative must be established.

- Measuring Outcomes – the value of an alternative is evaluated in terms of goal attainment. Sometimes an outcome is expressed directly in terms of a goal. For example, profit is an outcome, profit maximization is a goal, and both are expressed in dollar terms. An outcome such as customer satisfaction may be measured by the number of complaints, by the level of loyalty to a product, or by ratings found through surveys. Ideally, a decision-maker would want to deal with a single goal, but in practice, it is not unusual to have multiple goals. When groups make decisions, each group participant may have a different agenda. For example, executives might want to maximize profit, marketing might want to maximize market penetration, operations might want to minimize costs, and stockholders might want to maximize the bottom line. Typically, these goals conflict, so special multiple-criteria methodologies have been developed to handle this.

- Risk – all decisions are made in an inherently unstable environment. This is due to far too many unpredictable events occurring in both the economic and the physical environments. Some risk (measured as probability) may be due to internal organizational events, such as a valued employee quitting or becoming ill, whereas others may be due to natural disasters, such as a hurricane. What can a decision-maker do in the face of such instability?… In general, people have a tendency to measure uncertainty and risk poorly. People tend to be overconfident and have an illusion of control in decision-making. This may perhaps explain why people often feel that one more pull of a slot machine will definitely pay off… In some cases, some decisions are assumed to be made under conditions of certainty simply because the environment is assumed to be stable. Other decisions are made under conditions of uncertainty, where risk is unknown. Still, a good decision-maker can make working estimates of risk. Also, the process of developing a business intelli-gence/decision support system (BI/DSS) involves learning more about the situation, which leads to a more accurate assessment of the risks.

- Scenarios – a scenario is a statement of assumptions about the operating environment of a particular system at a given time; that is, it is a narrative description of the decision-situation setting. A scenario describes the decision and uncontrollable variables and parameters for a specific modeling situation. It may also provide the procedures and constraints for the modeling… A manager can construct a series of scenarios or what-if cases, perform computerized analyses, and learn more about the system and decision-making problem while analyzing it. Ideally, the manager can identify an excellent, possibly optimal, solution to the model of the problem… Scenarios are especially helpful in simulations and what if analyses. In both cases, we change scenarios and examine the results.

- Errors in Decision-Making – the model is a critical component in the decision-making process, but a decision-maker may make a number of errors in its development and use. Validating the model before it is used is critical. Gathering the right amount of information, with the right level of precision and accuracy, to incorporate into the decision-making process is also critical.

- An overview of business analytics – is there a difference between analytics and analysis? Even though these two terms are being used interchangeably, analytics is not exactly the same as analysis. In its basic definition, analysis refers to the process of separating a whole problem into its parts so that the parts can be critically examined at the granular level. It is often used for complex systems where the investigation of the complete system is not feasible or practical; therefore, the analysis definition needs to be simplified by decomposing it into its more descriptive/ understandable components. Once the improvements at the granular level are realized and the examination of the parts is completed, the whole system (either a conceptual or a physical system) is then put together using a process called synthesis. Analytics, on the other hand, is the variety of methods, technologies, and associated tools used for creation of new knowledge/insight to solve complex problems and to make better and faster decisions. In essence, analytics is a multi-faceted and multi-disciplined approach to addressing complex situations. Analytics takes advantage of data and mathematical models to make sense of the ever-so-complicated world that we are living in… Even though analytics includes the act of analysis at different stages of the discovery process, it is not just analysis but analysis, synthesis, and everything else.

- Why the sudden popularity of Analytics? Need – as we all know, business is anything but “as usual today. Previously characterized progressively as local, then regional, then national, the competition is now global. Large to medium to small, every business is under the pressure of global compe-tition. The barrier that sheltered companies in their respective geographic locations with tariffs and transportation costs are no longer as protective. In addition to and perhaps because of – the global competition, customers have become more demanding… Availablity and affordability – thanks to recent technology advances and the affordability of software and hardware, organizations are collecting tremendous amounts of data… Cultural change – at the organizational level, there is a shift from old-fashioned intuition-driven decision-making to new-age fact/evidence-based decision-making. Most successful organizations are making a conscious effort toward shifting into a data/evidence-driven business practice. Because of the availability of data and supporting IT infrastructure, such a paradigm shift is taking place faster than many have thought.

- What are the main challenges of Analytics? Analytics talent– data scientists, as many people today call the quantitative geniuses who can convert data into actionable insight, are scarce in the market, and the really good ones are difficult to find. Because analytics is relatively new, the talent for analytics is still in the process of development… Culture. As the saving goes, old habits die hard.” Changing from a traditional style which is often characterized with intuition and gut feelings as the basis of making decisions) to a contemporary management style (which is based on data and scientific models, to base managerial decisions, to data/evidence and collective organizational know-edge) is not an easy process to undertake for any organization. People do not like to change… Return on investment another factor behind analytics adoptions is the difficulty in clearly justifying its return on investment (ROI). Because analytics projects are complex and costly endeavors and their return is not clearly and immediately related, many executives are having a hard time investing in analytics, especially in large scales. One has to answer the question… Data – the media is talking about “Big Data” in a positive way, characterizing it as an invaluable asset for better business practices. That is mostly true, especially if the business understands and knows what to do with it. For the others, who have no clue, Big Data is a big challenge… Technology – even though it is capable, available, and to some extent, affordable, technology adoption poses another chal. lenge for traditionally less techmical businesses. Despite being affordable, it still takes significant money to establish an analytics infrastructure… Security and privacy one of of the most commonly pronounced criticisms of data and analytics is security. As we often hear in the news about data bridges for sensitive information, there is no completely secured data infrastructure unless it is isolated and disconnected from all other networks (which would be something that goes against the very reason of having data and analytics).

- A simple taxonomy for Analytics – the author presents this image, based on an Analytics definition outlined through INFORMS, to explain this concept.

- Descriptive amalytics is the entry level in analytics taxonomy It is often called business reporting because most of the analytics activ. ities at this level deal with creating a report to summarize business activities to answer the question ‘What happened?” or ‘What is happening?” The spectrum of these reports includes static snapshots of business transactions delivered to knowledge workers (decision-makers) on a fixed schedule; dynamic views of business performance indicators delivered to managers and executives in an easily digestible form-often in a dashboard-looking graphical interface- on a continuous manner; and ad-hoc reporting where the decision-maker is given the capability of creating her own specific report (using an intu-itive, drag-and-drop graphical user interface) to address a specific or unique decision situation.

- Descriptive analytics is also called Business Intelligence (BI) and predictive and prescriptive analytics are collectively called advanced analytics. The logic behind calling part of the taxonomy advanced analytics is that moving from descriptive to predictive or prescriptive is a significant shift in the level of sophistication, which warrants the label of “advanced.” BI has been one of the most popular technology trends for information systems designed to support managerial decision-making since the start of the century. It was popular until the arrival of the analytics wave (to some extent, it still is popular in certain business circles)… Analytics characterizes BI as the entrance level to the world of analytics, setting the stage and paving the way toward more sophisticated decision analysis. These descriptive analytics systems usually work oft a data warehouse, which is a large database specifically designed and developed to support BI functions and tools.

- Predictive analytics comes right after the descriptive analyticsin the three-level analytics hierarchy. Organizations that are matured in descriptive analytics move into this level, where they look beyond What happened and try to answer the question “What will happen?”… Prediction essentially is the process of making intelligent/scientific estimates about the future values of some variables like customer demand, interest rates, and stock market movements. If what is being predicted is a categorical variable, the act of prediction is called classification; otherwise, it is called regression. If the predicted variable is time-dependent, the prediction process is often called time-series forecasting.

- Prescriptive analytics is the highest echelon in analytics hierarchy. It is where the best alternative among many that are usually created/ identified by predictive or descriptive analytics courses of action is determined using sophisticated mathematical models. Therefore, in a sense, this type of analytics tries to answer the question “What should I do?” Prescriptive analytics uses optimization, simulation, and heuristics-based decision-modeling techniques. Even though prescriptive analytics is at the top of the analytics hierarchy, the methods behind it are not new. Most of the optimization and simulation models that constituted prescriptive analytics were developed during and right after World War II in the 1940s, when there was a dire need to do the best and the most with limited resources. Since then, prescriptive analytics has been used by some businesses for specific problem types, including yield/revenue management, transportation modeling, and scheduling.

Leave a comment